Annual 403b Contribution Limits 2025

BlogAnnual 403b Contribution Limits 2025. If you're 50 or older, you can contribute an. In 2025, the combined limit for employer contributions and employee elective salary deferrals is $69,000.

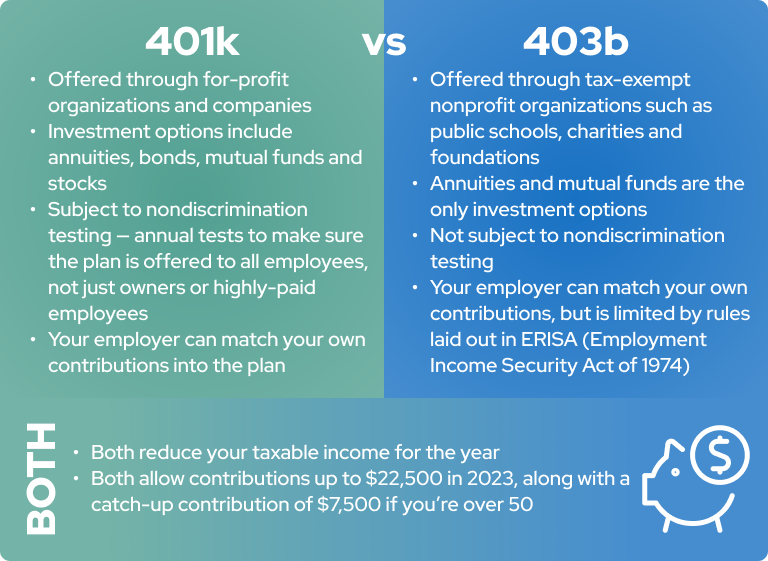

401 (k), 403 (b), 457 (b), and their roth. The internal revenue service recently announced the annual 403 (b) limits for 2025.

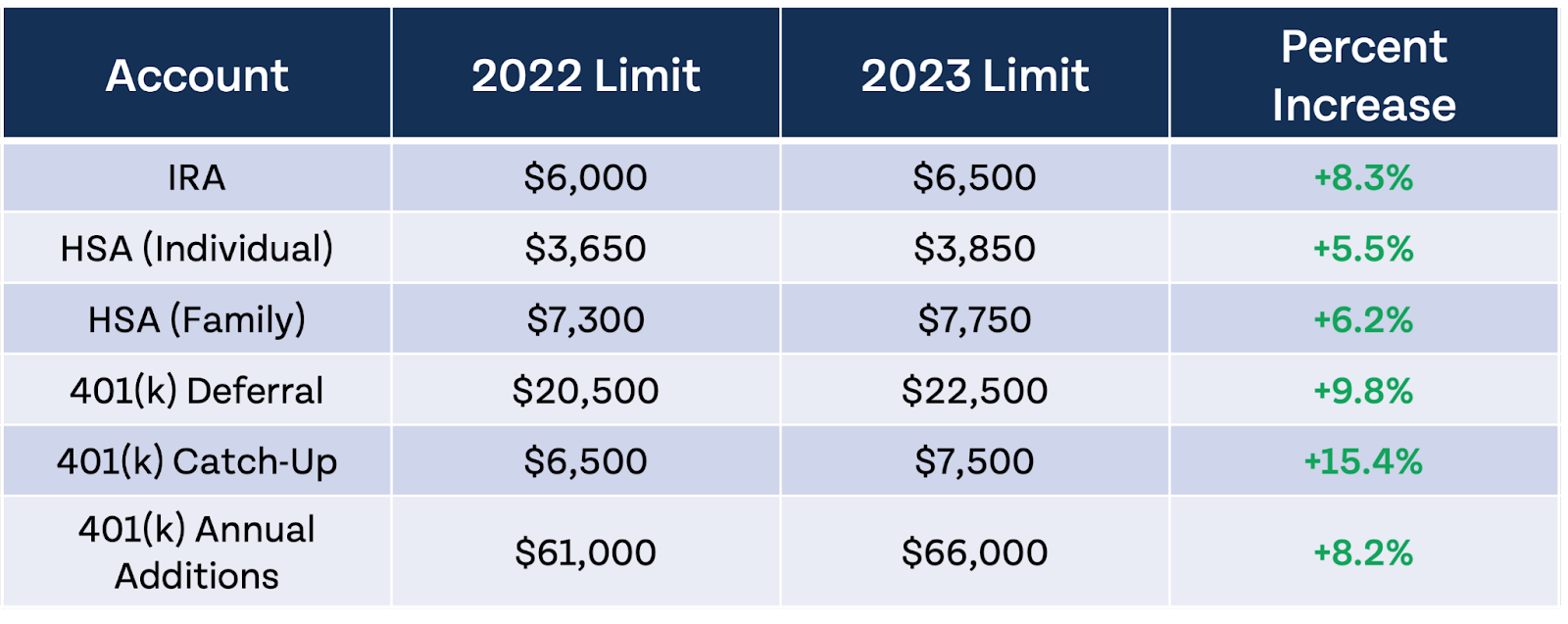

2025 Contribution Limits Announced by the IRS, The maximum 403 (b) contribution for 2025 is $23,000. The contribution limit for 403 (b) plans is $23,000 in 2025 for workers under age 50, up $500 from $22,500 in 2025.

Roth IRA 401k 403b Retirement contribution and limits 2025, The maximum 403 (b) contribution for 2025 is $23,000. Contribution limits for 403(b)s and other retirement plans can change from year to year and are adjusted for inflation.

403(b) Retirement Plans TaxSheltered Annuity Plans, This is the total amount that you can contribute to your 403 (b) plan from your salary before taxes. The limit on annual additions (the combination of all employer contributions and employee elective salary deferrals to all 403 (b) accounts) generally is the lesser of:.

The IRS Just Announced 2025 Tax Changes!, The maximum amount an employee can contribute to a 403 (b) retirement plan for 2025 is $23,000, up $500 from 2025. The internal revenue service has declared an increase in the maximum contribution limits for 401 (k) plans in 2025, raising it to $23,000 from the 2025 limit of.

403(b) Contribution Limits for 2025, 0 32 7 minutes read. In 2025, you can contribute up to $23,000 to a 403 (b).

401(k) Contribution Limits in 2025 Meld Financial, The maximum amount an employee can contribute to a 403 (b) retirement plan for 2025 is $23,000, up $500 from 2025. If you are age 50 or older in.

2025 HSA Contribution Limits Claremont Insurance Services, 0 32 7 minutes read. 2025 roth ira contribution limits 2025 income.

IRS Limits on Retirement Benefits and Compensation EisnerAmper Wealth, 401 (k), 403 (b), 457 (b), and their roth. Annual addition limits for 403(b).

What’s the Maximum 401k Contribution Limit in 2025? (2025), Under the 2025 limits, the 403 (b) retirement plan maximum contribution, as an elective deferral, is $23,000. 403(b) contribution limits in 2025 and 2025 contribution limits for 403(b)s and other retirement plans can change from year to year and are adjusted for inflation.

How Much Can I Contribute To My 401k In 2025 Audrye Jacqueline, 0 30 8 minutes read. The 403b contribution limits for 2025 are: